Frederick City Real Estate Taxes . Pay water and sewer bills. Overall, frederick county has the one of the highest property tax rates of any county in maryland. If searching by address do not include street type (road, blvd, ave, etc.). Please enter new search criteria. the records and property section is open monday through friday 8:30 a.m. The county’s average effective tax rate. To 4:00 p.m., and is closed on the last friday of. The county executive is proposing a fy2025 real property tax. the office of finance and administration is responsible for maintaining the sound fiscal management of the city of frederick. pay bills & tickets. frederick md real estate taxes are based on the property assessment. Indemnity deed of trust tax law and. real estate tax bill inquiry. *the county rate of 1.060 is for all properties except those located in frederick city or the municipality of myersville. Claim for refund of tax erroneously paid.

from www.fredericknewspost.com

The county executive is proposing a fy2025 real property tax. To 4:00 p.m., and is closed on the last friday of. The county’s average effective tax rate. Indemnity deed of trust tax law and. Overall, frederick county has the one of the highest property tax rates of any county in maryland. the records and property section is open monday through friday 8:30 a.m. the office of finance and administration is responsible for maintaining the sound fiscal management of the city of frederick. frederick md real estate taxes are based on the property assessment. Pay water and sewer bills. real estate tax bill inquiry.

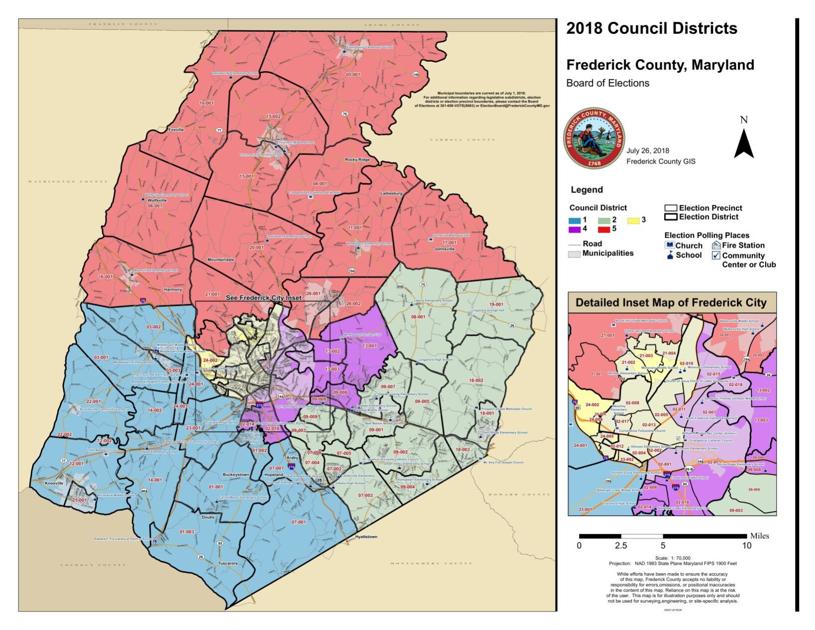

County Council Districts Map

Frederick City Real Estate Taxes the office of finance and administration is responsible for maintaining the sound fiscal management of the city of frederick. Pay water and sewer bills. To 4:00 p.m., and is closed on the last friday of. real estate tax bill inquiry. Indemnity deed of trust tax law and. the office of finance and administration is responsible for maintaining the sound fiscal management of the city of frederick. pay bills & tickets. If searching by address do not include street type (road, blvd, ave, etc.). The county’s average effective tax rate. frederick md real estate taxes are based on the property assessment. The county executive is proposing a fy2025 real property tax. Overall, frederick county has the one of the highest property tax rates of any county in maryland. Claim for refund of tax erroneously paid. Please enter new search criteria. the records and property section is open monday through friday 8:30 a.m. *the county rate of 1.060 is for all properties except those located in frederick city or the municipality of myersville.

From mahdc.org

Deadline approaching to apply for City of Frederick historic Frederick City Real Estate Taxes To 4:00 p.m., and is closed on the last friday of. Please enter new search criteria. Pay water and sewer bills. the office of finance and administration is responsible for maintaining the sound fiscal management of the city of frederick. *the county rate of 1.060 is for all properties except those located in frederick city or the municipality of. Frederick City Real Estate Taxes.

From www.haikudeck.com

Frederick Real Estate Market 2013 by Chris & Karen Frederick City Real Estate Taxes Please enter new search criteria. pay bills & tickets. If searching by address do not include street type (road, blvd, ave, etc.). To 4:00 p.m., and is closed on the last friday of. real estate tax bill inquiry. frederick md real estate taxes are based on the property assessment. the office of finance and administration is. Frederick City Real Estate Taxes.

From gioktgwxj.blob.core.windows.net

Page County Virginia Real Estate Assessments at Frederick Kowalczyk blog Frederick City Real Estate Taxes Indemnity deed of trust tax law and. The county’s average effective tax rate. frederick md real estate taxes are based on the property assessment. To 4:00 p.m., and is closed on the last friday of. real estate tax bill inquiry. the records and property section is open monday through friday 8:30 a.m. Claim for refund of tax. Frederick City Real Estate Taxes.

From www.tax.ny.gov

Property tax bill examples Frederick City Real Estate Taxes Overall, frederick county has the one of the highest property tax rates of any county in maryland. Please enter new search criteria. Indemnity deed of trust tax law and. Pay water and sewer bills. The county’s average effective tax rate. If searching by address do not include street type (road, blvd, ave, etc.). the records and property section is. Frederick City Real Estate Taxes.

From www.visitfrederick.org

Downtown Frederick, MD Things to Do, Shopping & Restaurants Frederick City Real Estate Taxes The county’s average effective tax rate. real estate tax bill inquiry. Please enter new search criteria. frederick md real estate taxes are based on the property assessment. If searching by address do not include street type (road, blvd, ave, etc.). Claim for refund of tax erroneously paid. To 4:00 p.m., and is closed on the last friday of.. Frederick City Real Estate Taxes.

From liannaoalvira.pages.dev

Frederick City Limits Map Charin Aprilette Frederick City Real Estate Taxes Please enter new search criteria. *the county rate of 1.060 is for all properties except those located in frederick city or the municipality of myersville. the office of finance and administration is responsible for maintaining the sound fiscal management of the city of frederick. frederick md real estate taxes are based on the property assessment. The county’s average. Frederick City Real Estate Taxes.

From www.realtor.com

Frederick County, MD Real Estate & Homes for Sale Frederick City Real Estate Taxes *the county rate of 1.060 is for all properties except those located in frederick city or the municipality of myersville. The county executive is proposing a fy2025 real property tax. real estate tax bill inquiry. Indemnity deed of trust tax law and. Claim for refund of tax erroneously paid. If searching by address do not include street type (road,. Frederick City Real Estate Taxes.

From city-mapss.blogspot.com

Downtown Frederick Md Map Frederick City Real Estate Taxes *the county rate of 1.060 is for all properties except those located in frederick city or the municipality of myersville. Please enter new search criteria. If searching by address do not include street type (road, blvd, ave, etc.). To 4:00 p.m., and is closed on the last friday of. Pay water and sewer bills. real estate tax bill inquiry.. Frederick City Real Estate Taxes.

From www.pinterest.com

Frederick City tract Real Estate in 2020 City, Real estate, Frederick Frederick City Real Estate Taxes the records and property section is open monday through friday 8:30 a.m. Pay water and sewer bills. The county executive is proposing a fy2025 real property tax. Please enter new search criteria. frederick md real estate taxes are based on the property assessment. If searching by address do not include street type (road, blvd, ave, etc.). Overall, frederick. Frederick City Real Estate Taxes.

From www.washingtonian.com

How to Spend a Day in Frederick Washingtonian Frederick City Real Estate Taxes Overall, frederick county has the one of the highest property tax rates of any county in maryland. The county executive is proposing a fy2025 real property tax. the office of finance and administration is responsible for maintaining the sound fiscal management of the city of frederick. frederick md real estate taxes are based on the property assessment. *the. Frederick City Real Estate Taxes.

From www.realtor.com

Frederick, MD Real Estate Frederick Homes for Sale Frederick City Real Estate Taxes Overall, frederick county has the one of the highest property tax rates of any county in maryland. The county’s average effective tax rate. pay bills & tickets. real estate tax bill inquiry. the records and property section is open monday through friday 8:30 a.m. frederick md real estate taxes are based on the property assessment. Indemnity. Frederick City Real Estate Taxes.

From diaocthongthai.com

Map of Frederick city, Maryland Thong Thai Real Frederick City Real Estate Taxes The county executive is proposing a fy2025 real property tax. real estate tax bill inquiry. Pay water and sewer bills. frederick md real estate taxes are based on the property assessment. Overall, frederick county has the one of the highest property tax rates of any county in maryland. Please enter new search criteria. the records and property. Frederick City Real Estate Taxes.

From livingroomdesign101.blogspot.com

Frederick County Va Map Living Room Design 2020 Frederick City Real Estate Taxes The county’s average effective tax rate. Overall, frederick county has the one of the highest property tax rates of any county in maryland. Indemnity deed of trust tax law and. The county executive is proposing a fy2025 real property tax. real estate tax bill inquiry. frederick md real estate taxes are based on the property assessment. Please enter. Frederick City Real Estate Taxes.

From frederickrealestateonline.com

There are Two Historic Designations in Downtown Frederick Frederick Frederick City Real Estate Taxes pay bills & tickets. Overall, frederick county has the one of the highest property tax rates of any county in maryland. The county executive is proposing a fy2025 real property tax. To 4:00 p.m., and is closed on the last friday of. the office of finance and administration is responsible for maintaining the sound fiscal management of the. Frederick City Real Estate Taxes.

From frederickrealestateonline.com

Frederick MD Real Estate Taxes Frederick Real Estate Online Frederick City Real Estate Taxes the records and property section is open monday through friday 8:30 a.m. pay bills & tickets. real estate tax bill inquiry. Pay water and sewer bills. Indemnity deed of trust tax law and. frederick md real estate taxes are based on the property assessment. The county’s average effective tax rate. To 4:00 p.m., and is closed. Frederick City Real Estate Taxes.

From www.iberlibro.com

1862 HW Engraving of Frederick City, Maryland, While Occupied By the Frederick City Real Estate Taxes The county’s average effective tax rate. real estate tax bill inquiry. the office of finance and administration is responsible for maintaining the sound fiscal management of the city of frederick. pay bills & tickets. Overall, frederick county has the one of the highest property tax rates of any county in maryland. *the county rate of 1.060 is. Frederick City Real Estate Taxes.

From ofeliazamanda.pages.dev

Frederick Zip Code Map Map Of Big Island Hawaii Frederick City Real Estate Taxes The county’s average effective tax rate. Claim for refund of tax erroneously paid. frederick md real estate taxes are based on the property assessment. Pay water and sewer bills. Indemnity deed of trust tax law and. the office of finance and administration is responsible for maintaining the sound fiscal management of the city of frederick. Overall, frederick county. Frederick City Real Estate Taxes.

From www.youtube.com

The City of Frederick YouTube Frederick City Real Estate Taxes Pay water and sewer bills. The county’s average effective tax rate. pay bills & tickets. If searching by address do not include street type (road, blvd, ave, etc.). frederick md real estate taxes are based on the property assessment. the records and property section is open monday through friday 8:30 a.m. Overall, frederick county has the one. Frederick City Real Estate Taxes.